By Madonna Dennis

Sadia Biloo lost $1.5 million that weekend but then made another $2 million to make up for it.

A screen at the front of the room displays “BP Commodities Case” and is facing tables full of students. Each student is in front of a desktop PC or laptop, but all are open with the same programs.

Imagine opening tabs of research for an essay, except these tabs have charts and bars showing stock prices. The tabs are labelled news, trader info, time and sales.

Four members of the Ryerson financial math team sit together. Biloo acts as a producer of BP oil. She can lease storage units for her oil, but once it reaches a certain point she has to pay more money. She doesn’t realize until it’s too late.

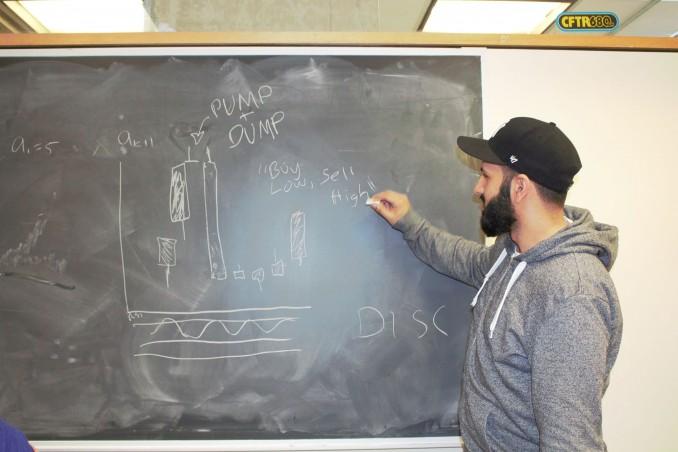

“You don’t have a moment to waste. You have to be able to manage risk quickly; make decisions quickly,” says Nasser Mohsin, the team’s trainer. He’s talking about the similarities between the industry and the competition.

“The difference is that they aren’t dealing with real money,” he says.

The team consists of students from Ryerson’s financial math program. First-years Biloo and Aysel Ineza, and second-year Harjas Singh, Abel Olivares, Varun Jagota, and Shawn Mapilot competed in the Rotman International Trading Competition (RITC) from Feb. 19-21.

RITC is held every year at the University of Toronto’s Rotman School. Heading into its 13th year, the competition brings together schools from around the world for a weekend of cases and industry exposure. The simulated stock market gives students a chance to apply their knowledge to a real life trading experience. Throughout the weekend several companies present themselves to the students to show them what’s out there in the world of trade. The competition had a total of six cases that were weighted differently.

“We were kind of scared going in. The last week before it was kind of like are we even ready to go? Should we even go?”

The team placed 44th out of 50 schools, facing powerhouses like the University of California, Berkeley and the University of Windsor. Not to mention most students in attendance were completing their Masters and PhDs. A volunteer came up to them during the event to tell them they were the youngest team there.

Starting in late November, the team met once a week, practicing cases given to them by Mohsin. Their practices became more serious as the competition drew closer.

“We were kind of scared going in. The last week before it was kind of like are we even ready to go? Should we even go?” says Biloo.

The team’s best competition was the Algorithmic Trading Case. A stock is random and can go up or down at any point. The point of the competition was to find a way to exploit this randomness. Singh and Jagota did this by creating an algorithm that would track mispricings so they could manipulate errors in the data to profit.

The duo placed 21st out of 50 teams, beating out both of Rotman’s own teams, plus Waterloo and the Massachusetts Institute of Technology.

“[The BP Commodities Case] was the most fun. It was the most team-based oriented,” says Mapilot.

The traders, Olivares and Ineza bookend the producer, Biloo, and the refiner, Mapilot. They are working as BP Oil; Biloo producing the oil and setting the price for which it sells, and Mapilot refining the oil to make gasoline and heating oil. From there, the traders Olivares and Ineza go forth and trade with the other teams.

“Everyone was like ‘Up, up! Down, down! We even made signals,” says Mapilot.

The volume amps up once teams get into the swing of things. Screams of “Buy! Sell!” are heard in the room. Other teams even yelled out the wrong news to try and trick competitors.

Each of the four heats last 16 minutes with a two minute break in between. The news given to Mapilot only comes every two to three minutes. In the meantime, the traders could either sit and wait or speculate which way the market would go. The big screen is switched off with a minute left in the competition. It’s anyone’s guess who will come out on top.

When teams weren’t trading or in a case, there was an event hall where every school gathered. There a screen showed the top 25 schools in a competition happening at that moment. The Ryerson team struck up a conversation with a team from Dublin, Ireland, who were sitting near them. Both teams were up on the board and started rooting for each other.

“It got to a point where we were actually yelling and going ‘Oh my God it’s actually going up!’”

“It got to a point where we were actually yelling and going ‘Oh my God it’s actually going up!’ We all stood up and watched,” says Biloo.

This sense of camaraderie came naturally to the younger team, by laughing pretty much the whole time other groups were drawn to them.

“We’re just sitting there laughing, having a good time and he turns around and he’s like ‘You guys are having way too much fun,’” says Ineza, referring to a competitor from the University of Connecticut who could not help but joke around with the team.

Since the competition, Singh has become president of the Financial Mathematics Course Union, with Ineza and Biloo as VPs. Ineza, Mapilot and Biloo are also looking to start a trading club.

Mohsin says he attributes all this to the competition.

“You can’t be creative unless you’re a leader,” Mohsin says. “It’s always the leaders that are creative because it’s always the leaders that will challenge things.”

The team will be be training to for RITC again in the fall semester, with the plan to start earlier than last year.

Leave a Reply