By Dylan Marks

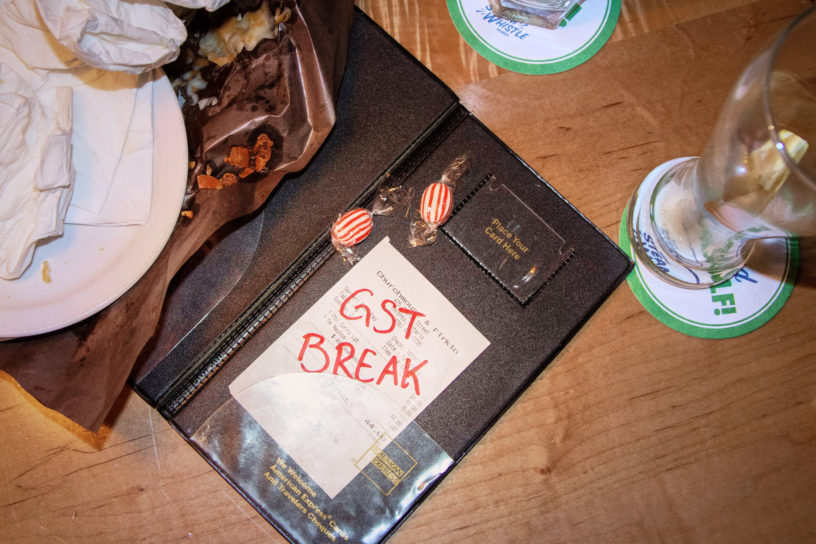

With the recent Goods and Services Tax (GST) and Harmonized Sales Tax (HST) break, students say the financial relief wasn’t enough, despite the government’s attempt to save Canadians more money.

Starting on Dec. 14, 2024, the federal government implemented a tax break on items such as prepared foods, snacks, beverages, children’s products, toys, entertainment and seasonal items.

According to a press release from the Canadian federal government, “This tax break will make a meaningful difference for Canadians by making essentially all food GST/HST free, providing real relief at the cash register.” The program is set to end on Feb. 14, when GST and HST will be reinstated on all goods and services.

However, some students are finding that daily necessities not included in the tax break are still heavily impacting their budgets. Second-year global management studies student Evan Haverluck said although the tax break helps him “get more out of [his] money” on certain items, he still believes that the tax break isn’t enough to impact regular expenses.

“If they lowered the price of [taxes on] gas and stuff that I spend money on every week, I definitely would [save] more,” said Haverluck.

“Students probably don’t pay much tax because their income is likely not at the current threshold for tax”

Byron Lew, professor and chair of economics at Trent University, believes there are other ways for governments to help people on lower-income budgets outside of a tax break.

“You can provide them with better tax breaks on their income tax,” he said. This would raise the minimum income level required to start paying taxes, allowing for more effective financial relief for those who could benefit the most.

“Students probably don’t pay much tax because their income is likely not at the current threshold for tax. So what would benefit students would be just more availability of student funding, bursaries, grants, particularly for students from low-income families,” said Lew.

According to the Chartered Professional Accountants of Canada (CPA) website, the federal tax break policy does not boost economic growth and the GST/HST cut may encourage consumer behaviour—such as delaying purchases, rebuying items or stockpiling goods—which also won’t benefit business owners.

According to the CPA website, “[The tax break] accomplishes little and it will be costly for businesses and the government—it will increase the federal budget deficit and HST-participating provinces will have to be compensated for their share of the HST that was not collected.”

The CPA website also noted that many of the goods in the tax break are not essentials, making it challenging to justify the added expense to the federal treasury. This echoes the idea that the tax break as a whole could have had a larger benefit if it focused on necessities, which low-income earners would prefer to have breaks for.

Similar to Haverluck’s wishes for a tax break on regular necessities, third-year retail management student Hamza Hasan feels the tax break is pointless as he doesn’t spend enough to fully benefit from it.

“If you want to help low-income people, there are better ways”

“I think it was good for a little bit but it really doesn’t make much of a difference,” Hasan said. “To incentivize spending more, I need more income, so the tax break does save a little bit of money but it’s not enough to make me spend more.”

Hasan added that unless there is a full GST/HST tax break on everything, it doesn’t make a significant difference on finances and spending habits.

Rob Gillezeau, assistant professor of economic analysis and policy at the University of Toronto, said the tax policy as a whole was the wrong way to go.

“Just as a basic idea, it’s bad tax policy. My advice to the government would be [to] determine your actual objective. If it’s the desire for more dollars to be in people’s pockets, we have all sorts of income-tested transfers to get that job done,” said Gillezeau. “If you want to support working low-income folks, you could boost the Canada Workers Benefit. If you want to focus on families, you could use the Canada child benefit…There are lots of things we could do.”

According to the Canadian Federation of Independent Business (CFIB) website, hundreds of business owners have called the CFIB to express concern about implementing the GST/HST break. Many are worried about making a mistake in interpreting the rules, especially given the rushed nature of the change. “This entire initiative has been poorly designed and rushed,” the CFIB website stated.

Due to this hastened nature, Gillezeau feels the tax break was implemented by the government as a politically motivated gesture.

“Probably the biggest unintended consequence [of the tax break] is that it was a political gimmick designed to boost the Prime Minister’s fortunes, and he has now resigned. So I don’t think it was successful in achieving their primary goal,” said Gillezeau.

Elisabeth Gugl, associate professor of economics at the University of Victoria, backed this idea, and said that she doesn’t see the point of the tax break due to its short-term nature.

“It’s very temporary and it’s weirdly specific about what is and is not exempt, and so it seems very gimmicky,” she said.

Gugl added that during the holiday season, people may have felt rewarded by the tax break with the government making them feel like they were receiving some sort of gift. “We know that currently, the Liberals are not polling well, and there have to be elections fairly soon, and so that seems to be more like a politically motivated policy, rather than something that makes a lot of economic sense in the long run,” Gugl said.

Fourth-year computer science student Timo Kwok, said although the tax break has made him increase his willingness to spend more on groceries, he also feels the new policy seems to have been created for the purpose of swaying opinions politically with an incentive.

“As a whole, I think that it might be a bit of a ploy. That’s not the right word, but sort of a way to influence opinions about the election and the party’s performance,” said Kwok.

Gugl said, “Given the serious issues with things like housing affordability, I think that a policy that would have targeted people who really need to have more financial help would be better than this kind of broad across-the-board break for two months.”

Leave a Reply