No impulse food runs all week? Biz & Tech editor Astoria Luzzi and Communities editor Victoria Stunt tried it and saved big

Last week from Monday to Friday, we quit spending. Cold turkey. Recently we have noticed how much money we spend merely because we haven’t been managing our time.

We rush to get to school and don’t leave time to make lunches, so we buy food impulsively throughout the week. As third-year journalism students who work approximately 25 hours a week on campus, planning meals isn’t often our first priority.

We decided it was time for a change in budgeting.

So we quit. Impulsively, that is.

The plan was to spend money only on essential groceries and not spend on a whim for a week.

This meant we couldn’t grab a coffee on the way to school, fulfill a chocolate craving, or venture down to Oakham Café for a quick meal to-go.

“It might be the shock value that someone needs in order to get started with making some changes,” said Julie Jaggernath, education media manager from the Credit Counselling Society. She added that putting a stop to spending abruptly is the hardest way to go.

“Would you be able to carry out those changes for six months? Or for the whole semester?” she said.

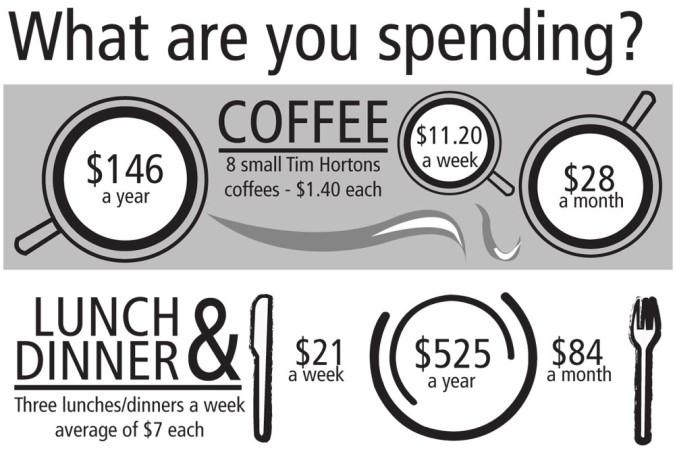

Getting used to the changes took some doing. Going from buying an average of eight small coffees in a week, which totals about $11.20, to not being able to fulfill our caffeine fix while on-the-go, left us frustrated and tired.

“We are creatures of habit, we love our habits, they give us comfort, they give us routine…” said Jaggernath. We started our experiment the Monday after reading week. Like most students, the first week back welcomed us with long periods at school filled with studying for midterms and meeting deadlines.

With the demanding weeks that students face, we found that it can be difficult to make time to grocery shop, resulting in the unplanned spending habits we have developed. In fact, Victoria couldn’t find the time to do a full grocery shop until Friday of that week.

Our first attempts at breaking our spending habits varied in success.

Jaggernath told us that we needed to “switch the habit…’cause you can’t take away a habit, you need to replace it with something.”

Astoria packed a healthy pasta salad accompanied with juice, snacks and tea-making supplies to fulfill her hunger throughout the day. Victoria, still without groceries but determined to stick to the challenge, managed to survive her first day of no-spending with free crackers from a soup bar and a homemade bean salad. That night, Victoria was able to make a sandwich with some small groceries she bought from the pharmacy near her apartment.

The first few days of the challenge prompted us to take the planning more seriously and replace our habits with more money-conscious ones. We ended up following the same advice we received from Jaggernath.

She said that if you know you will be getting home late from class, and will be too tired to cook, “a day or two ahead of time cook something that has enough leftovers so that you know there is something sitting and waiting for you.” We did exactly that and it made our experiment a lot easier.

Reaching the end of the week, we realized how much we were saving, which prompted us to ask the question, “How much had we been spending normally?” We buy eight small coffees, three cheap lunches or dinners, and three snacks per week, which we estimated would be about $1046 per year.

That amount is comparable to one sixth of the average tuition, two months rent, ten metro passes or a round trip flight to Buenos Aires, Argentina. Would you stop buying food on impulse to go on that much needed vacation? We would.

Leave a Reply