In an increasingly expensive world, what does it mean for millennials to spend money on themselves?

By Anastasia Andric

It was the summer of 2017 and Sam D’Amico had just finished a twelve-hour work day at the waterpark where she was supervising. As her shift ended on a particularly hot day, she felt exhausted but decided to make one more stop before heading home. Her sister’s birthday was coming up and D’Amico remembered her sister mentioning there was a perfume she wanted.

The Chanel No. 5 perfume was pink and floral scented, in a square bottle with the logo written delicately across on a white label. The second-year sociology student from Ryerson University stood in front of the store shelf as she contemplated whether or not it was worth buying. It was close to $120. She had a difficult time deciding whether it was worth the amount or not. While she knew her sister would like it, D’Amico felt guilty thinking about spending that much money. It was in that moment that she thought of her mom who always talks to her about budgeting and saving her money as a young adult.

How are you going to buy a house one day in a good neighbourhood if you don’t start to save money right now? The sound of her mother saying this ran through her mind, among dozens of other things. She thought about what she would do if she wanted to move out, buy a car or travel, and knew that it wouldn’t be an option if she were making such expensive purchases regularly.

As she stood in front of the lavish perfume bottle, she realized her mother was right. Her mother always encouraged her to save money for the future and deep down D’Amico knew that was exactly what she needed to do.

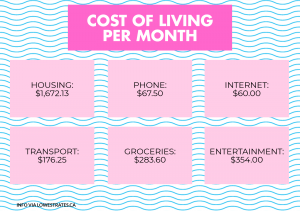

With expenses such as rent, commuting, groceries and tuition, it is almost impossible for millennials to save money and stick to a budget while also having fun.

D’Amico decided not to buy the perfume and headed toward the GO train. She started to feel guilty for not buying her sister a gift, but also knew she would be breaking the bank if she spent that much money. As she rode the train home, D’Amico felt a wave of worry come over her because she didn’t know what else to buy her sister without spending too much money.

D’Amico is not the only millennial who feels guilty about spending money. A 2016 study by the Telegraph suggests that millennials have a difficult time saving money as a result of, “low pay, high living costs and a bleak economic future.” With expenses such as rent, commuting, groceries and tuition, it is seemingly impossible for millennials to save money and stick to a budget while also having fun. Many are torn between saving for the future or spending it on things they actually enjoy. This often leads to feelings of guilt when spending money on themselves.

Jonathan Farrar, Chair of Accounting in the School of Accounting and Finance at Ryerson, says there are two main reasons why millennials have a difficult time saving money. The first reason is that some parents don’t encourage saving from an early age, which leads to a hard time planning for the future. The second is that the high cost of living makes it difficult to save because millennials have little disposable income to play around with.

Jonathan Farrar, Chair of Accounting in the School of Accounting and Finance at Ryerson, says there are two main reasons why millennials have a difficult time saving money. The first reason is that some parents don’t encourage saving from an early age, which leads to a hard time planning for the future. The second is that the high cost of living makes it difficult to save because millennials have little disposable income to play around with.

“There is a psychological barrier—if I know I can hardly make ends meet, why bother saving and why bother thinking about saving?” says Farrar. “Saving may be perceived as too difficult.” On top of this negative mindset, Farrar also says that it is easier to spend money now than ever before. He says it is important for millennials to keep track of where their money goes and to start saving as soon as possible.

According to The Psychology of Desire, a book about human needs, “we tend to prioritize our current desires over our long-term goals.” For this reason, millennials may find it difficult to save money for a result that could take years to show, and instead prefer purchases that are instantly gratifying. This discourages millennials from saving up for future investments.

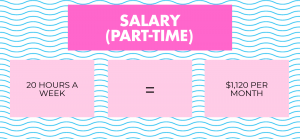

Akif Anwar is a first-year business technology management student who recently transferred to Ryerson from Laurier. He works part-time in retail, making about $1,000 per month. He spends about $300 on the GO train from Mississauga each month to get to school. In addition, he pays $80 per month for his phone bill and buys his own groceries on top of that. Anwar says he’s lucky because his parents are paying for his rent and tuition, but

he still struggles to save money. He feels guilty when he buys something for himself because he has such high bills to pay.

A few weeks ago on a cold Tuesday morning, Anwar was on his way to class when he spotted a Winners. He was on the hunt for a pair of gloves when he found a pair that really caught his eye. They were $30, but Anwar really liked them and bought them anyway. The soft leather perfectly hugged his hands and he instantly fell in love. It was his first pair of leather gloves and he was happy to buy them. However, Anwar had second

though afterwards because he knew he could have gone somewhere else for a cheaper pair.

Like most of his friends, Anwar finds it difficult to save money. “Rates are going up and everything seems to be more and more expensive—it seems impossible for millennials to buy houses now whereas for previous generations it was easier,” he says. “I usually have to think twice before every purchase.” He knows it’s important to save money but he also wants to spend money on himself once in a while. But like most millennials, it’s hard to spend money on yourself knowing you have other, more important expenses.

Farrar suggests millennials should start planning for the future as soon as possible. “Even if it is not the most glamorous thing to have, a budget will enable you to see how much money is coming in and how much is going out,” he says. Farrar believes millennials have a hard time understanding where their money goes. “It is important to keep track of the money and put as little or as much away into savings from every paycheck you get,” he suggests. Millennials should get in the habit of saving now so that they can have something for the future.

How are you going to buy a house one day in a good neighbourhood if you don’t start to save money right now?

In early January, Anwar was watching TV when he spotted a commercial for the Google Home. He was instantly mesmerized decided that he should buy it. He took a trip to the mall where he saw the Google Home in person. He felt excited and happy about the new device in the moment but realized that it was unnecessary. He soon felt guilty for spending that much money on something he didn’t really need.

A 2013 article in Bustle suggests that millennials are “extremely susceptible to buyer’s remorse.” Most millennials find it difficult to spend money on themselves without worrying or feeling guilty. Farrar says that the difference between this generation and previous ones is mainly the job market. “Many people now have [many] different jobs and careers and it is harder to have stability which makes it harder to save money.”

D’Amico spent her entire summer working to get her hard-earned paycheques. She made around $10,000, and when it was over, she tried her best to put as much money as she could in her savings. It was during those tiring days of lifeguard duty that she really learned the value of money. She also knew that she had to save up because her job was seasonal.

When fall 2017 came and D’Amico was in school, she had to be smart with her money so it wouldn’t all disappear. Living in Maple, in Vaughan, she relies on the GO Train to take her to school. Her transit costs her about $125 per month, and she puts away another $50 per month for textbooks. D’Amico always thinks about the importance of saving, which is why she rarely buys a coffee on her way to school.

“I’ll get a coffee, once every two to three weeks and I’ll get worried that if I keep buying into coffee that I’m wasting money. Or I get nervous that if I’ve made a certain amount and if I start spending even a small amount, it’s all going to disappear,” says D’Amico.

all going to disappear,” says D’Amico.

The same goes for her wardrobe. “If I’ve earned this money should I really waste it on something like a shirt or a bunch of clothes?” says D’Amico. “I always hear people saying things like, ‘how are you going to buy a house?’ or, ‘do you know how much it’s going to cost to move out?’ and because of that I like to know that I at least have some money saved,” says D’Amico. She wants to save money so she can have the option to further her education or buy a house.

Having money saved for the future makes her feel confident. She knows that if she continues to put money aside instead of spending it, she will be more financially independent. “I like to know that I am saving money because you never know when something bigger, more expensive, will come your way,” says D’Amico.

Leave a Reply