By Christina Flores-Chan

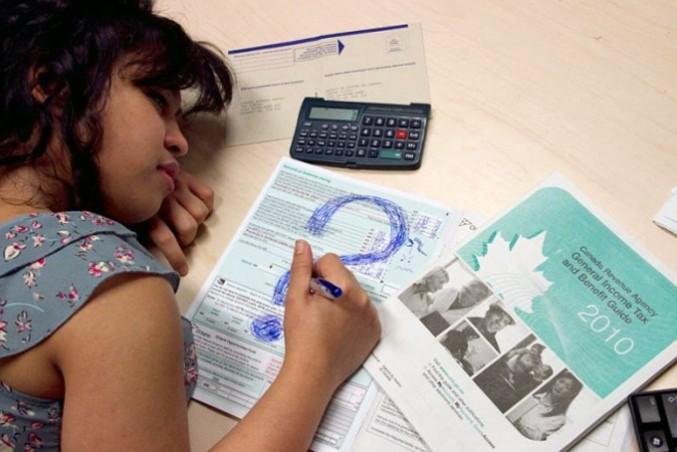

It’s tax season again and if the idea of sitting at the kitchen table drowning in stacks of documents and a calculator doesn’t sound appealing to you, you’re not alone.

For most, the annual tax filing process can seem tedious, lengthy and for first-timers, completely foreign. Fortunately, according to the Canada Revenue Agency (CRA), there are ways to make completing an annual tax return simple.

The government uses taxes to provide services like education and healthcare to the country—contributing to those common goods is part of being a Canadian citizen.

This year, the filing deadline for most individuals is Saturday, April 30. Those who filed on time should have their tax returns received or postmarked by May 2.

Filing your returns is a two-way street though, and students often receive federal, provincial and territorial benefits and credits upon completion.

The Eyeopener spoke to CRA spokesperson Amanda Sebastian-Carrier about the agency’s recent tax guide, “What students need to know this tax season,” and how students can maximize their benefits this year.

“It’s important for people to file tax returns so that they don’t miss out on benefits or entitlements like the quarterly GST credit, the Ontario Trillium benefit and the climate action incentive,” Sebastian-Carrier says.

While eligibility for the Goods and Services Tax credit (GST), Ontario Trillium benefit and Climate Action Incentive depend on individual factors such as the province in which citizens reside and their income, tuition fees can be included on every post-secondary student’s tax returns.

“Students can get tax credits for their tuition fees,” Sebastian-Carrier says. “If you don’t need to use them all this year, they can carry forward or transfer up to $5,000 of their credits to parents, spouses or grandparents.”

Carrying forward unused tuition fees may be beneficial to use in future years and although students are no longer able to claim education and textbook fees, they might still be able to carry forward any amounts from previous years.

For new graduates or those paying off student loans, Line 31900 of a tax return allows interest paid on loans to be claimed as well, a point that Sebastian-Carrier uses to emphasize the importance of filing taxes regardless of income.

Other expenses that students may be able to claim on their returns include moving expenses, occupational trade education, child-related expenses and more.

For those who are currently employed, the CRA advises that they verify the information on their T4 slips to ensure their name, employer and the amount of income is correct. Verifying all required forms before filing your taxes streamlines the process later.

People should routinely update and verify the information they submit to the CRA. This includes a person’s address, marital status and personal and banking details, found under the ‘My Account’ section of CRA’s platform.

According to Sebastian-Carrier, government documents that might have otherwise been lost or more difficult to access on hardcopy are all available online.

If a T4 slip is issued to a student’s temporary address, such as a university residence or student housing, rather than the permanent address that the CRA has on file, it would still be accessible online.

“You can check and update information online or by calling us at our tax enquiries line,” Sebastian-Carrier adds. “We’d be happy to answer any questions you have.”

Another crucial item to include in your tax returns is the T4A information slip regarding COVID-19 benefits (like the Canada Recovery Benefit), issued to citizens from the Government of Canada. Quebec residents will receive both a T4A information slip and an RL-1 slip.

In the process of completing their tax returns, Sebastian-Carrier alerts students about scams and fraud involving people who pretend to be the CRA and attempt to access Canadians’ personal and banking information.

“As tax season gets underway, scams seem to increase,” she says. “We never ask for personal or financial information by email. And if you receive a call saying you owe money to CRA, you can call our 1-800 number to check and one of our agents will be able to verify that.”

Sebastian-Carrier recommends students who are new to doing their taxes further educate themselves on the Canadian system and its importance with CRA’s new online course: Learn about your taxes.

Any other general inquiries and questions can be directed to +1 800-959-8281, the agency’s individual tax enquiries line.

Leave a Reply