By Milla Ewart

Even with increased access to information, some Toronto Metropolitan University (TMU) students feel apprehensive about their financial literacy, while others remain confident.

Financial experts attribute the growing gap to information overload, lack of mandatory financial education and limited financial conversations. A 2025 survey from Wallet Hub reports more than one-quarter of Gen Z said they lack confidence in their financial knowledge.

To assess TMU students’ financial literacy, The Eyeopener sampled eight students at the Ted Rogers School of Management and at the Student Learning Center to answer the “Big Three” questionnaire, a standardized test created by economists Annamaria Lusardi and Olivia Mitchell, covering interest rates, inflation and risk diversification.

The small survey suggests that despite possessing basic financial understanding, many are uncertain about their literacy. All students surveyed answered at least two questions correctly, but most rated their financial literacy as weak.

All students surveyed said they have felt financial pressure in their life within the last year.

Rebekah Smylie, a certified financial counsellor and program manager for financial empowerment at West Neighbourhood House, sees the overwhelming access to information as the issue that inhibits students from learning about money management.

“Gen Z’s are sitting in a space where they are having to pick through all of that [information] and decide what is true and what is fiction—that is really hard,” she said.

Smylie’s statement holds true for TMU students, as all the survey participants gathered financial information and advice from different mediums.

Sarah Matthews, a first-year performance production student said “It’s mostly my family giving me [financial] advice.”

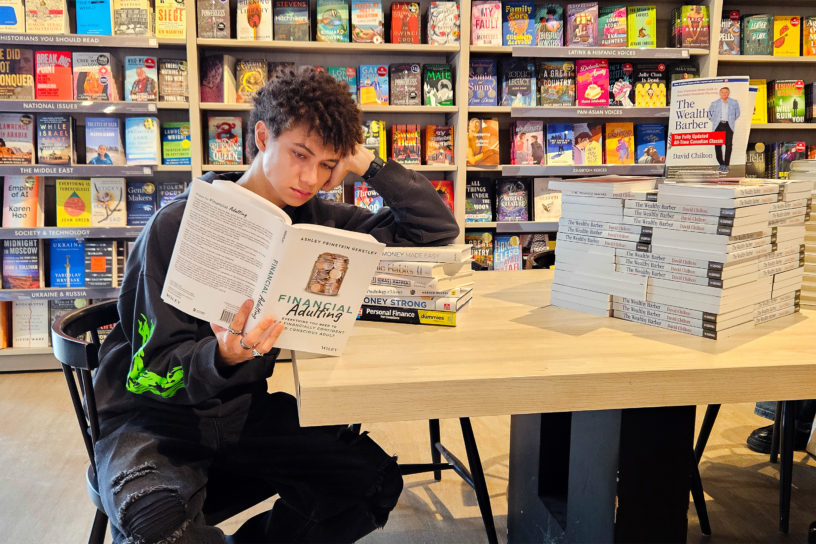

Third-year business management student Sebastian Kokalo gains his knowledge from academic and news sources. “I have been watching Bloomberg [TV] for the past three years, looking at economic reports, how the economy moves and reading books,” he said.

Smylie also points to Gen Z’s “apprehension and a fear to participate,” saying that uncertainty and limited understanding often discourage financial engagement.

Anna Mukendi, a first-year performance production student was discouraged by negative interactions with financial managers. “The way I saw it was, he sees a young girl opening up her first account, and then [proceeds to] mansplain everything,” she said in reference to a banking manager who unknowingly discouraged her from attaining more financial knowledge.

Ari Robinson, a fourth-year environmental and urban studies major, felt unequipped to manage his finances strategically. “I set up budgets for how much I am gonna spend on groceries, but I feel like every time I do it, it’s always wrong,” she said.

Chad Izatt, manager of digital media and programming for the Canadian Foundation for Economic Education (CFEE), is working alongside the Department of Education across Canada, to reintegrate financial education into school curriculums.

“Gen X and millennials had access to different information—that doesn’t help Gen Z,” he said, describing the need to implement a curriculum that is relevant to the recent economic climate.

The Ontario Ministry of Education introduced a new financial literacy graduation requirement as part of the Grade 10 curriculum. The requirement is scheduled to take effect in high schools in September 2026.

While Gen Z missed out on foundational financial education in school, Smylie emphasizes the need for them to discuss money in day-to-day life.

“It has been historically taboo to talk about money, but it’s so important, talk about what you’re learning,” said Smylie.

Leave a Reply