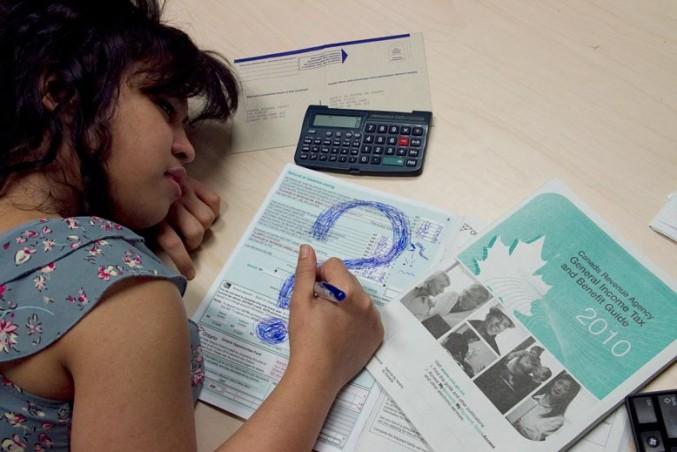

Tax season is upon us, but that doesn’t mean you have to suffer through a mountain of paperwork. Biz & Tech editor Ian Vandaelle reports

Tax season often leaves people with sweaty palms and sleepless nights as they ponder deductions, dependants and debt.

For many students, this year will mark the first time they’ve filed a tax return themselves. But have no fear! Though the April 30 deadline is fast approaching, there are plenty of resources at your fingertips for making it through tax season scot-free.

The essentials

For any tax return, students will need a few important documents: a T4 slip, which is proof of employment income, a T2202A slip for proof of tuition fees and your social insurance number.

The T2202A can be obtained through RAMSS, while your T4 should be obtained from your employers.

Where to go with it

There are a number of prime resources both within and around Ryerson to get your taxes done quickly and easily.

The Ryerson Students’ Union offers a number of free tax clinics later this month where Canadian Revenue Agency (CRA) trained volunteers will do your taxes.

The clinics run from Monday, March 21 to Friday, March 25 from 11 a.m. to 5 p.m. at the RSU main office on the third floor of the SCC. If you miss making those dates, the clinics continue in the TRSM the following week, from Monday, March 28 to Wednesday, March 30, during varying hours.

These clinics are by appointment only and can be scheduled on the RSU’s website.

But if your schedule doesn’t work with these dates, what can you do? Why, go to a tax services institution! While there are a number of such services around campus, none are better known than H&R Block. While less appealing (and more expensive) than the RSU clinic, H&R Block does offer student rates for tax returns and can accommodate a busier schedule. The flat rate for students is $29.95.

The DIY method

There’s always the do-ityourself method for go-getters. While paper applications are available from the post office, the quick and easy way is through digital submission.

A number of digital tax programs offer free or very cheap software to students and lowincome taxpayers. UFile offers a free online tax program for students, allowing you to obtain peace of mind knowing that your taxes are filed and you know exactly what went into the required fields. Other options include AceTax, which offers an $8 online program, or TurboTax, a $17 option.

These online tax returns can be printed and mailed to the Canada Revenue Agency, or can be filed completely digitally through NETFILE, Canada Revenue Agency’s online portal.

If this is your chosen option, be sure to check NETFILE’s online list of approved programs, or you may be left redoing your taxes in an approved program.

Taxes driving you crazy? Let me know at business@ theeyeopener.com. For more information, visit the Canada Revenue Agency website at cra.gc.ca.

Photo by: Chelsea Pottage

Leave a Reply