The chance for big, quick gains is luring students to play the stock market but season traders say it’s important to play smart and invest with your head, not your heart.

By Mike Oliveira

Every second, every blip on the computer screen, fortunes can be lost or gained. While some students check e-mail and send instant messages in computer labs, others chart their stock picks and anxiously watch as the market jumps up for a quick profit, or dives and loses its value.

Some throw every spare cent into the hottest stock and the nervous, stirring stomach never goes away. A lucky guess on a stock could mean a nice profit and a reading week getaway, or it could result in a major loss, a deep debt and unpaid bills.

From Monday to Friday, 9:30 a.m. to 4:30 p.m., the stock exchange is open for business and Ryerson students are among the investors sweating every ripple in the market.

The lure of the market and a fast buck caught 19-year-old Ben Miu’s eye in high school. Since then, he’s seen the highest of highs and the lowest lows while trading sticks.

Miu, a second-year business student, says he started investing when he was about 15 to 16 because there were better ways to spend his money than at the mall, like most of his friends.

He first dipped into mutual funds and penny stocks with about $400 from a savings account and was quickly hooked after turning an easy, alebit small, profit.

“I bought a mutual fund, held it for a while and then sold it for a $5 profit. Sure it wasn’t much, but at that age, it was pretty good,” Miu says.

With a new sense of confidence, Miu looked to carry his success into the big leagues of the Toronto Stock Exchange, and began buying into companies in the gold industry.

A fun hobby soon became much more serious and Miu began trading aggressively. He seesawed between profits and losses until the age of 17 when he took a big hit.

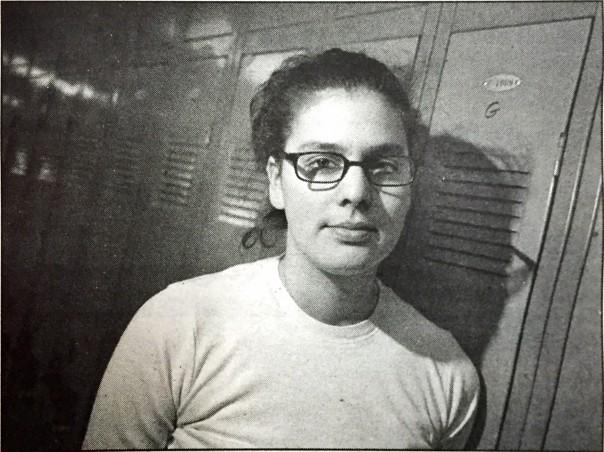

The rush of watching your money grow is both fun and dangerous, says Rachel Kagan, president of the Ryerson Stock Exchange.

“When I first got into the stock market, I got addicted to it. I just started buying a lot, all the time,” says Kagan. “It’s fun but you can get greedy. At the time (in the late 19902), everyone was buying and you’d get caught up in it. But I’ve changed my philosophy and I’m more careful now.”

Kagan started the student group last year to discuss investment strategies on campus, and promote awareness and education about the stock market. The group now boasts 100 members on its mailing list.

“Patience, discipline and commitment are really important. You have to be willing to ose the money you invest,” Kagan says. “It is a gamble.”

Miu was ready to gamble again after taking a brief break from investing, and he set his eyes on Nortel — then a rising star in the telecommunications industry.

The dot-com hysteria had the market growing beyond its means, with hype and speculation overriding traditional market-valuation tools and common sense.

Miu applied for credit cards — despite the fact that he was too young — and used cash advances to throw all the money he could behind the emerging Canadian company that seemingly couldn’t lose.

“Nortel was my biggest gain, that’s when they were going up all the time,” says Miu of his early success with the technology company.

“It kept getting bigger and bigger and the banks kept increasing my credit limit so I bought in even more. I liked the idea of investing more. If you only have $1,000, the stock has to go up by so much for you to make any real money.”

That kind of investment rationale is a big mistake, says Patricia Lovett-Reid, vice-president of TD Asset Management. She says there’s no such things as a sure bet and it’s dangerous to buy into the thinking that “if everyone’s doing it, it must be right.”

“The last thing you want to do is to invest on speculation,” Lovett-Reid says. “Make informed decisions, base your trades on sound investment advice and do your research. Take emotions out of investing, because they can often dictate your transactions.”

Kagan agrees that getting emotional can be a major problem, particularly for first-time investors.

“Sometimes you get to like a stock too much and you get attached. Never buy a stock you love,” says Kagan, adding that she’s lost out on some major profits by selling a stock too late and thinking with her heart instead of her head.

Like many other computer-savvy investors, Miu became fixated on the second-by-second progress of his stocks.

“Sometimes when I wasn’t at school, I’d have the computer on and I’d watch it all the time, getting instant quotes within seconds,” Miu says.

But just as analysts had warned, the tech boom didn’t last forever and, soon, Miu was watching his stock slowly slip before it suddenly started free falling.

The Nortel stock began to tank and would eventually lose more than three quarters of its value. The stock once sold for $124.50 in the summer of 2000 but now it languishes just about the $10 mark.

“When Nortel crashed, I lost a ton of money, probably around $10,000,” says Miu. “Imagine losing $2,000 in one second… that morning was not a nice morning. I stopped trading. I was just terrified with the amount of money I lost.”

Miu says he went through a serious bout of depression and family and relationship problems but maintains his trading days aren’t over.

After his parents helped handle his massive debt and after learning more about business at Ryerson, Miu thinks he’s ready to get involved again.

He says he’s come a long way from the heady days of stock stardom.

“I was too obsessed back then. It is addictive. It can be like gambling, but I’m smarter now.”

Lovett-Reid says it’s not necessarily a bad idea for students to be investing, but it has to be done right.

“The first thing you should do is pay down your debt instead of investing,” she says.

“But if you’re debt-free, look at a good, balanced mutual fund. Speak to a financial planner or analyst and figure out how much risk you can take on.”

Lovett-Reid says that based on the last three to six months, and the historic trends of economic recovery, the time may be good to make a solid investment, but she urges investors to proceed with caution.

Kagan adds, “with today’s GIC (Guaranteed Investment Certificate) rates are also so low that you can borrow to invest but even that, to me, is quite risky. The key is to have a diversified portfolio and never spend money you can’t afford to lose.”

Miu says that his current investments are very conservative and that his freewheeling days are over, at least for now.

“I think I’m going to sit with my Bombrdier stock but I’m also looking at bond strategies. You can’t make much money on bonds but I’m just looking to make a couple bucks,” says Miu.

“I’m keeping an eye on Nortel but I don’t think I’ll touch it.”

Leave a Reply